by Patrick Rawson & Louise Borreani, Ecofrontiers.xyz

“The cybernetician’s mission is to combat the general entropy that threatens living beings, machines, societies, that is, to create the experimental conditions for a continuous revitalization, to constantly restore the integrity of the whole.” – Tiqqun, The Cybernetic Hypothesis

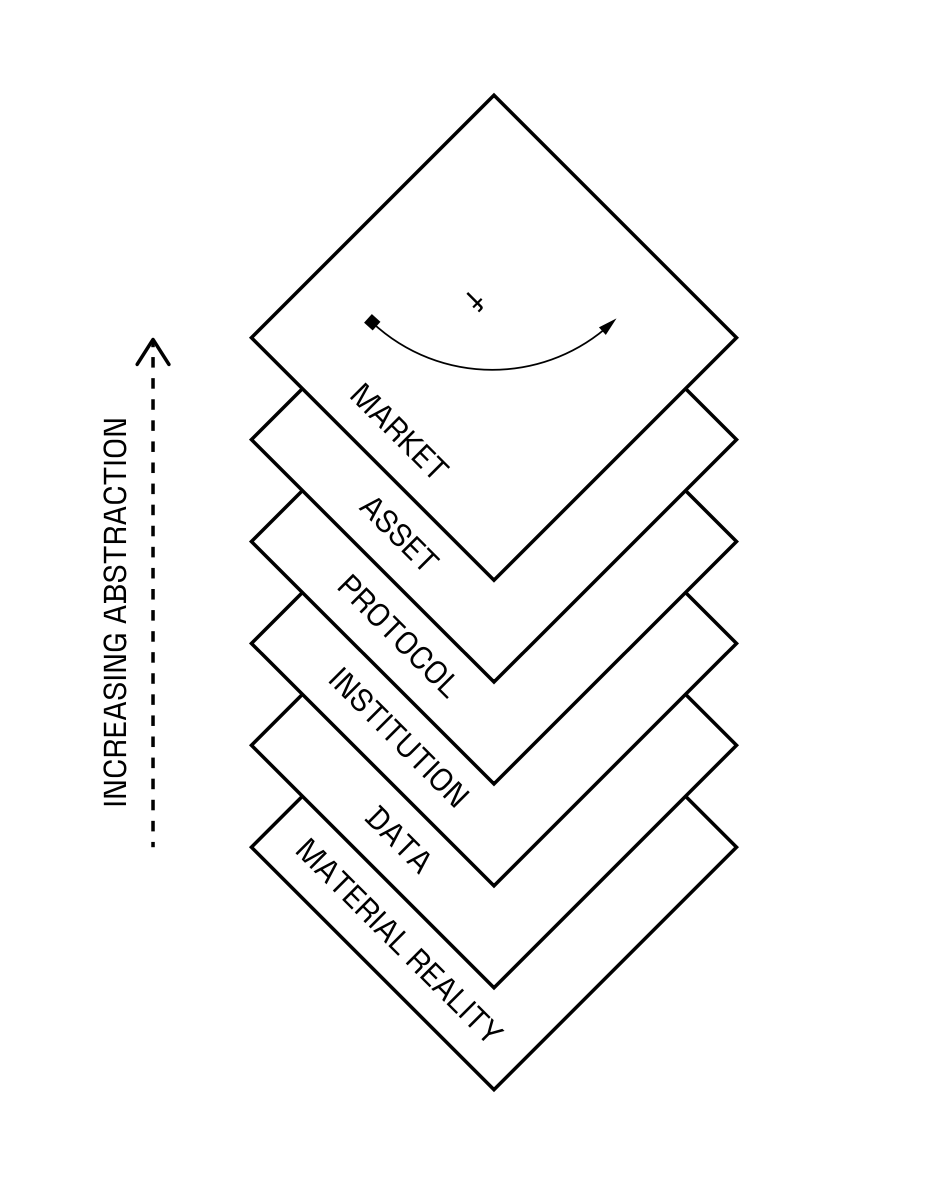

The Green Crypto Handbook (upcoming 2025) proposes a blockchain-based (alternatively: ‘Web3’) Environmental Finance Stack as a multi-layered framework that encompasses various material and conceptual layers as relating to the collective production of transferrable green crypto-assets (alternatively: ‘natural capital’). It aims to describe the cutting edge of planetary cybernetics through the new forms of living capital that Web3 evokes.

Web3’s generalized benefits1 offer a more ethical and novel path for eco-capitalist development, as the rights to produce, own, and profit from the production of green crypto-assets can be extended to all individuals at little to no operational cost. Web3’s immutable, transparent, and decentralized tools are game changing for green markets, where provenance, materiality, and accountability are paramount. The rise of crypto-institutional tooling and its immutable protocols effectively democratize asset production. Tokenization plays a crucial role, allowing the creation of new assets (“birth”) or the re-ledgering of existing assets (“rebirth”) using blockchain technology.2

Web3’s planetary-scale open liquidity environment facilitates digital asset exchange that transcends state-mediated markets that are often governed and restrained by developed nation interests. For instance, the development of a regenerative finance ecosystem3 in Africa is but one data point that showcases the potential of leveraging these tools in developing economies.4 Cryptomarkets’ unprecedented access and the accelerated capital formation a just and rapidly scaling climate transition requires. They are global, 24/7, universally accessible, and move capital at lightspeed, driving operational settlement costs to near-zero.

Cryptocurrencies have gained popularity, particularly among individuals with lower incomes5, indicating a broader reach and accessibility. While there is currently a significant sector focused on crypto-enhanced donations6, there is a non-negligible potential for crypto to move beyond philanthropy and find applications in various impactful sectors. It’s in this design milieu that The Green Crypto Handbook aims to plug existing gaps in the design literature describing the democratic production of green crypto-assets.

Web3’s Environmental Finance Stack

As mentioned, The Green Crypto Handbook identifies six layers critical to evolving eco-capitalism:

At its bottom is the Underlying Material Reality, the diverse family of planetary systems described by the natural sciences from which all financial abstractions are derived. Using human-designed tools of observation and measurement, human society translates the physical world into data. The contingent qualities of the technologies used for measurement and the translation of these measurements into accounting frameworks are mediated by the economy as an information-processing assemblage. While The Green Crypto Handbook is not about the epistemology of nature or science, these starting principles must be acknowledged as the basis by which environmental finance is epistemologically situated as accounting technology.

The Data Layer acts as the technical infrastructure responsible for the conversion of material reality into digital form, facilitating the transition from analog to digital representation. To measure the efficacy of ecosystem conservation and restoration efforts, one needs data. Data ultimately legitimizes all environmental stratagems in the production of green assets, as well as the institutions that originate them. As infrastructure, the data layer converts analog ecosystem complexities into actionable digital intelligence for evidence-based interventions. It presupposes and establishes the substrate on which territorial planning, sustainability initiatives, and financial abstractions must be developed.

The Institution Layer refers to the institutionalization process, the formal and normative decision and rule-making processes that filter the data layer and define protocol rules for the object representation—thus financialization—of green crypto-assets. Institutions ultimately define the overarching legal and regulatory frameworks, scientific methodologies, and technical protocols that delineate and govern green crypto production. They determine “techniques and procedures” that ultimately structure “the possible field of action.”7 Like all institutions, they compete and collaborate to secure economic factors of production—land, labor, capital, and innovation—in order to survive.

The Protocol Layer provides a structured definition for the production of assets governed by an established institution. As nodes in an institutional network, institutions exchange and incubate factors of production—land, labor, capital, and innovation—in order to ensure their long-term livelihoods and achieve well-defined objectives. The Protocol Layer deals with how crypto-institutions technically structure their intra- and inter-institutional relationships, covering those blockchain-based institutional protocols crypto-institutions use to exercise control and boost productivity for themselves and their neighborhoods. The affordances of these technical protocols are of particular importance to green crypto-institutions, whose supreme thermoreal imperative compels them to weave a planetary-scale institutional network that can “evolve fast enough to contain climate change” and resolve “fundamentally global problems… beyond the reach of existing institutional forms like nation-states and pre-internet global institutions such as the United Nations, World Bank, and IMF.”8

The Asset Layer arises from the systematic combination of the preceding layers, yielding a taxonomy of transferable green crypto-assets ready for market exchange. Assets are the oxygen of markets, and understanding the types of green crypto-assets that exist and can exist is paramount. A green asset, in comparison to a typical financial asset, is understood as a transferable financial object that generates a positive impact for the underlying material reality while providing economic benefit to its holder.

Finally, the Market Layer represents the conditions under which green crypto-assets are exchanged. Ultimately, the successful production and use of green crypto may come down to the conditions of its exchange in the global financial system. As mentioned, a singleton, planet-scale market in which all actors can compete on a level playing field is evolving in real-time.

In Conclusion

The rise of Web3 unlocks a new substrate for computational civilization to experiment with the production of new forms of natural capital. Ultimately, the goal of applying cybernetic principles to the 21st century economy “to combat the general entropy that threatens living beings”9 lives on and through Web3’s emerging environmental finance stack, which is uniquely poised to create socioecological networks that are resilient, responsive, and capable of achieving their adaptive objectives in a digitalized, dynamic, and climate-catastrophic world.

Back to Table of Contents | Previous: On Open Civic Systems | Next: Bioregional Organizing Networks

Footnotes

-

Simone Cicero, “Weighing the Impact of Web 3 Protocols on Platforms,” https://stories.platformdesigntoolkit.com/weighing-the-impact-of-web-3-protocols-on-platforms-ae98c8bef952 ↩

-

Teej Ragsdale, Jack Chong, & Mukund Venkatakrishnan, “An Unreal Primer on Real World Assets,” https://docsend.com/view/u53utyp2j4ycg7r6 ↩

-

Regenerative finance broadly refers to the application of ecological economics as applied to Web3. ↩

-

“ReFi projects in Africa May 2023,” https://pbs.twimg.com/media/FxY3gRfaIAA4X0K?format=jpg&name=medium ↩

-

Sebastien Derivaux. Twitter. Last modified May 23rd, 2023. https://twitter.com/SebVentures/status/1661063483369177108?s=20 ↩

-

“Your DAO”. Endaoment. https://app.endaoment.org/ ↩

-

Michel Foucault, “The Subject and Power,” Critical Inquiry 8, no. 4, 1982, pp. 777–795. ↩

-

Venkatesh Rao, Tim Beiko, Danny Ryan, Josh Stark, Trent Van Epps, and Bastian Aue, “The Unreasonable Sufficiency of Protocols,” Summer of Protocols, https://summerofprotocols.com/the-unreasonable-sufficiency-of-protocols-web ↩

-

Tiqqun, The Cybernetic Hypothesis, South Pasadena: Semiotext(e), 2020. ↩